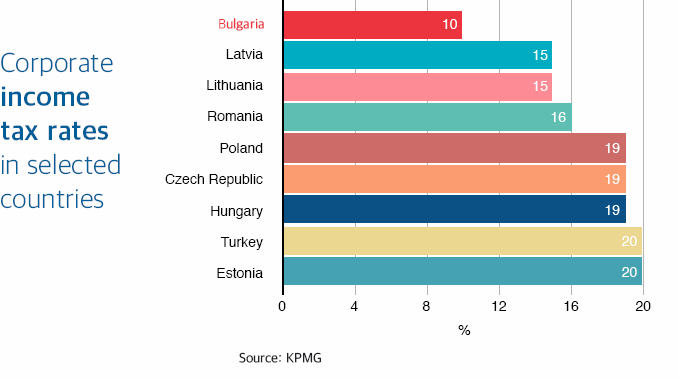

Bulgaria has one of the lowest corporate and personal income tax rates in Europe (10%). Bulgaria maintains lower corporate taxes compared to other IT & BPO destinations, where the tax on profits varies from 15 to 20%. The definition of “taxable profit” is reasonable, as genuine business expenses are tax deductible. Corporate income from production activities in high unemployment regions is tax exempt. Costs of fixed intangible assets created through research and development are also deductible. In addition, Bulgaria applies EU customs legislation and has signed double tax treaties with 68 countries.

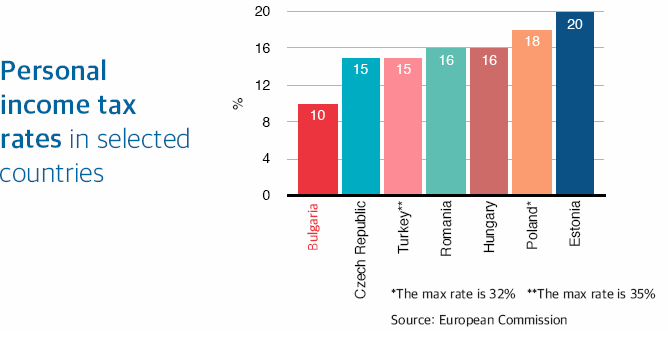

Bulgaria maintains one of the most favorable personal income tax systems in Europe. Personal income is subject to 10% flat tax rate. Individual income tax rates in Bulgaria are the lowest in the EU. Income tax rates are noticeably higher in other CEE countries. For example, in Romania personal income is taxed at 16%, while Central European countries such as Poland, Hungary and Czech Republic apply tax rates which vary from 15 to 18%.

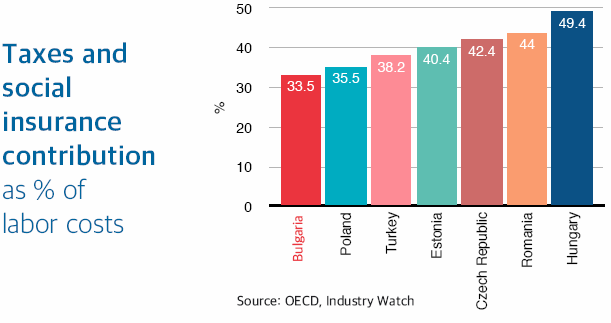

In Bulgaria both the employer and the employee pay social insurance contributions. Employer’s social contributions are 17%, while employee’s contributions amount to 12.9%. In 2015 the maximum monthly social security

base is BGN 2600 (€1327) and the minimum wage is BGN 380 (€194). In addition, there are minimum insurance thresholds which vary according to the profession and the economic sector. Personal income taxes and social insurance contributions constitute on average 33.5% of total labor costs. The labor tax burden in Bulgaria is smaller compared to other countries specializing in IT & BPO such as Poland, Turkey, Estonia, Czech Republic, Romania and Hungary.